Benefits

Benefits of the Prepayment Funding Service

- Early stage R&D companies typically have difficulties borrowing capital from the traditional bank lending community due to limited tangible assets to secure their borrowings.

- The R&DCP loans provide an innovative structure to allow you to borrow funds secured against your future tax return.

- This form of funding does not involve the issue of new equity thus avoiding any equity dilution.

- You can lengthen your cash runway without having to be distracted by the complexities of agreeing the business valuation and new shareholders’ agreements.

- The additional runway will allow you to achieve further project milestones to trigger uplift in shareholder value prior to any future equity raising.

- The R&DCP loans are available in a simple, efficient structure that can be accessed in a short time-frame.

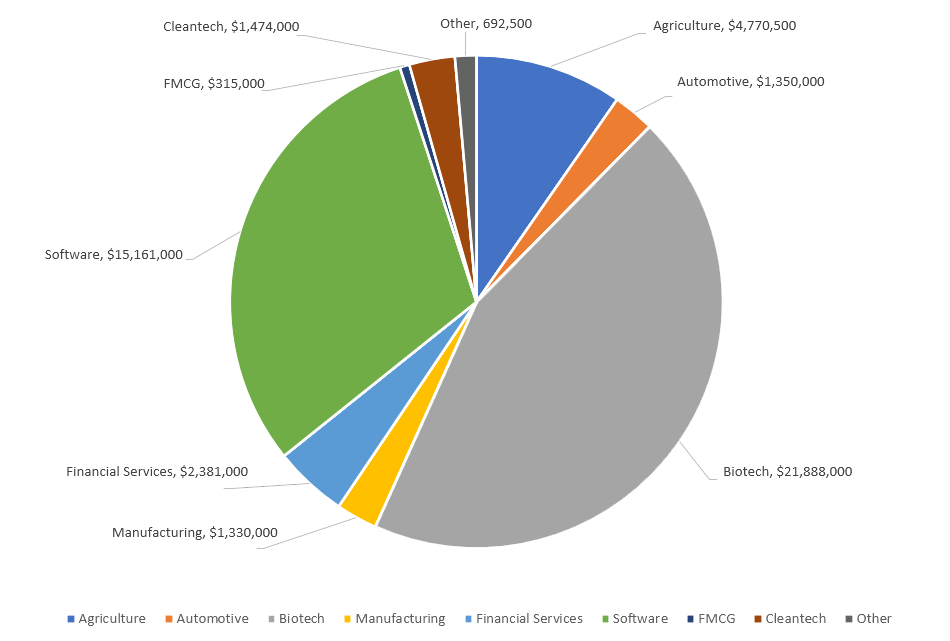

R&D Capital Partners lends to businesses across a range of industries.

The critical component of the lending criteria is the eligibility of the R&D expenditure.